AI chip agency Nvidia valued at $2tn

Nvidia’s market worth has shot above $2tn (£1.58tn), a brand new milestone within the chipmaker’s fast ascent into the ranks of the world’s most precious corporations.

Shares within the Silicon Valley agency rose greater than 4% in morning commerce on Friday earlier than dropping again a bit.

The positive factors prolonged a soar after the corporate’s blockbuster earnings report this week.

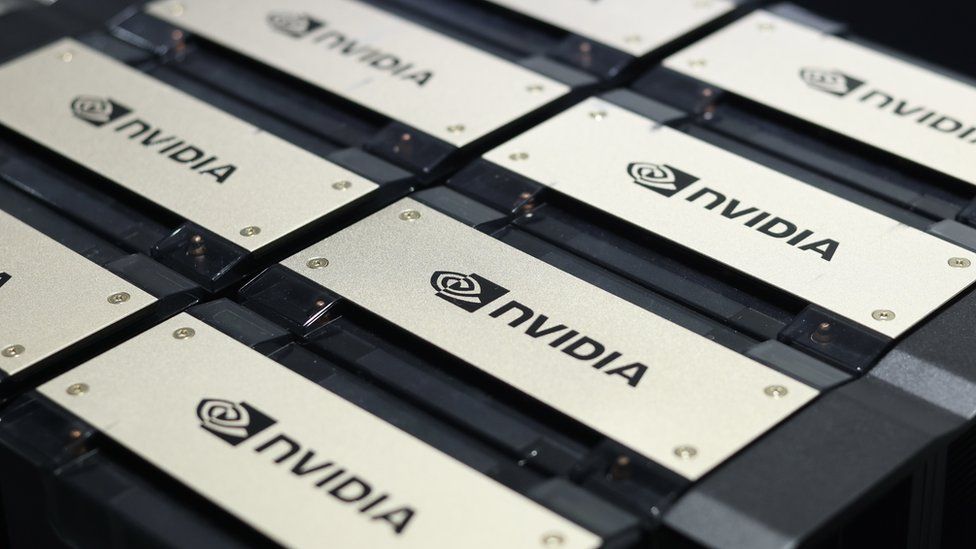

The firm is benefiting from advances in synthetic intelligence (AI), which have powered demand for its chips.

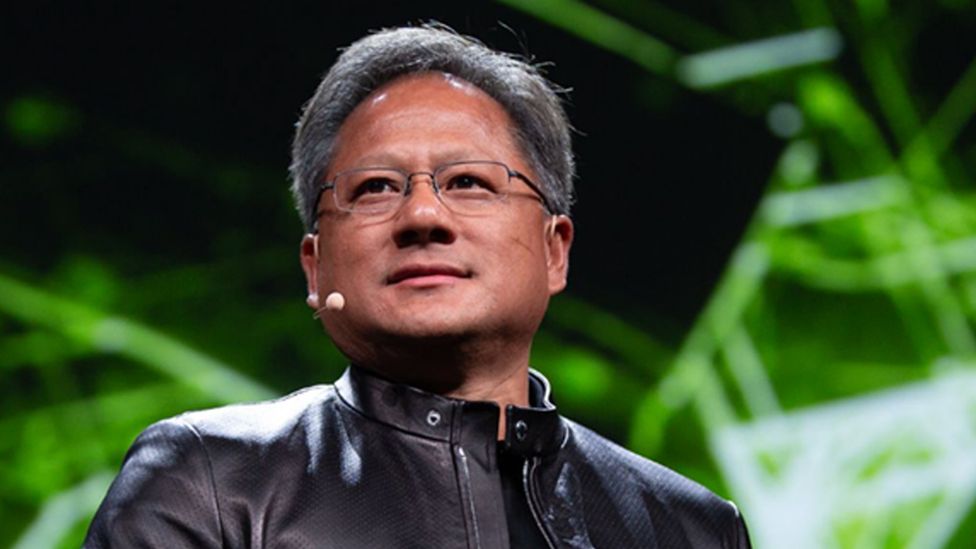

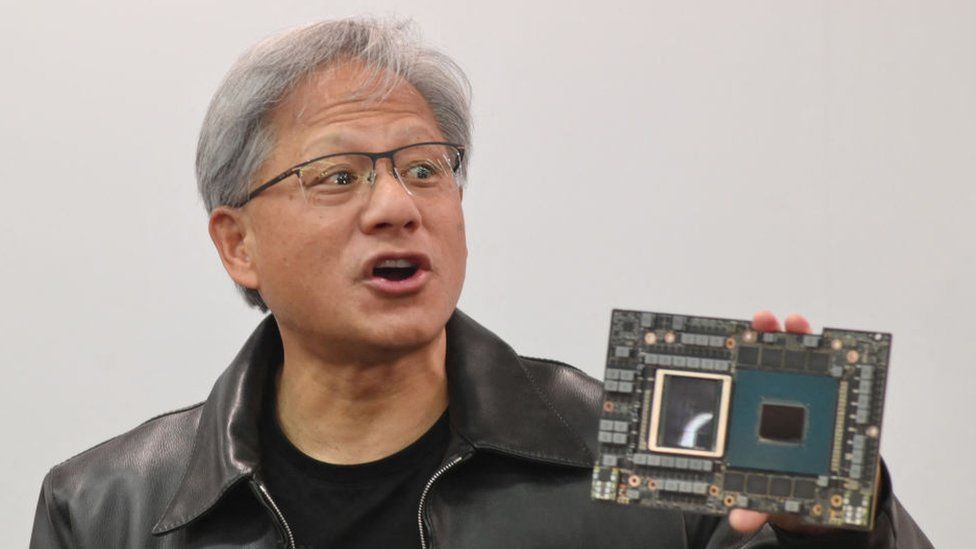

Turnover on the agency greater than doubled final yr to greater than $60bn, and boss Jensen Huang instructed buyers this week that demand was “surging” around the globe.

The firm, which grew to become price $1tn lower than a yr in the past, now ranks because the world’s fourth most precious publicly traded firm, behind Microsoft, Apple and Saudi Aramco.

After shares retreated from their highs, the agency’s market worth was hovering slightly below $2tn in mid-day commerce on Friday.

Founded in 1993, Nvidia was initially identified for making the kind of pc chips that course of graphics, notably for pc video games.

Long earlier than the AI revolution, it began including options to its chips that it says assist machine studying, investments which have helped it achieve market share.

It is now seen as a key firm to look at to see how briskly AI-powered tech is spreading throughout the enterprise world.

The worth of the agency’s shares has greater than tripled over the past 12 months, from lower than $240 apiece to just about $800 in mid-day commerce on Friday.

On Thursday, the day after its earnings report, consumers snapping up shares pushed its worth up by $277bn, Wall Street’s largest one-day achieve in historical past.

The report has additionally helped to drive a broader market rally, showing to persuade buyers that, as Derren Nathan of Hargreaves Lansdown put it, the growth in AI was “living up to the hype”.

“It’s being used in automotive for design, it’s being used in telecommunications for planning networks, it’s being used in mainstream companies to figure out and get insights into data that they haven’t been able to get before,” Bob O’Donnell, a US-based know-how analyst instructed the BBC earlier this week.

“This is now really starting to hit the kinds of companies across the board, not just specialised tech companies and that’s a real tipping point for the industry.”

Related Topics

-

-

1 day in the past

![Jensen Huang, now the chief executive of Nvidia, was one of its founders back in 1993.]()

-