AI: UK chip designer Arm sees shares virtually double

UK chip designer Arm Holdings has seen its inventory market worth virtually double in lower than per week as traders wager on the substitute intelligence (AI) increase.

The Cambridge-based firm reported monetary outcomes final Wednesday that confirmed demand for AI-related expertise is boosting its gross sales.

Chips designed by Arm already energy virtually each smartphone on the planet.

The agency was taken personal by Japan’s SoftBank in 2016 and it returned to the inventory market final September.

Arm’s shares have soared since its earnings announcement final week and are actually up by greater than 98%.

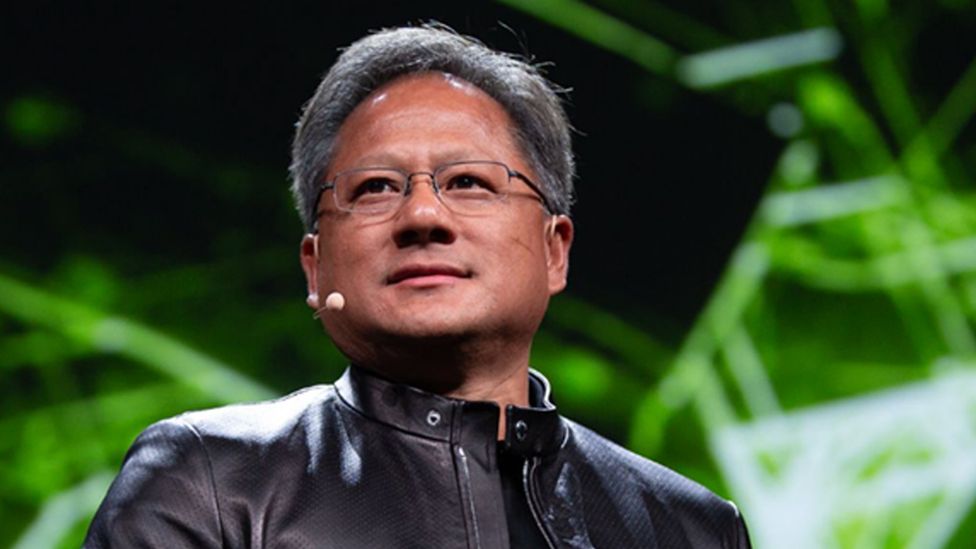

It comes as chipmaker Nvidia has seen its shares greater than triple in worth within the final 12 months on hovering demand for its AI chips.

The AI increase has helped Nvidia develop into some of the priceless publicly-traded firms on the planet, with a inventory market valuation of round $1.8 trillion (£1.4 trillion).

It has additionally made it the fifth publicly traded US firm to affix the so-called “Trillion-dollar club”, together with expertise giants Apple, Microsoft, Alphabet and Amazon.

Arm’s expertise will not be straight used for AI work, however chip makers like Nvidia are selecting it for central processing items (CPUs) that complement their AI-specific chips.

Aside from Nvidia and Taiwan Semiconductor Manufacturing Company (TSMC), Arm’s clients additionally embody well-known client manufacturers like Apple.

Demand for Arm-designed chips can also be rising within the automobile making business due to the event of self-driving expertise.

Arm was based in 1990 by a bunch chip designers within the college metropolis of Cambridge.

It was purchased by SoftBank in 2016 for $32bn. Four years later, the Japanese conglomerate introduced that it deliberate to promote Arm to Nvidia.

However, in April 2022 SoftBank shelved the deal after going through objections from regulators around the globe and mentioned it will as a substitute promote shares in Arm on the Nasdaq inventory change in New York.

The bounce in Arm’s shares is welcome information for SoftBank, because it has been hit by losses as a result of falling valuations of a few of its investments, together with struggling workplace area agency WeWork.

SoftBank, which nonetheless holds a roughly 90% stake in Arm, has seen its personal shares achieve virtually 30% up to now week.

Related Topics

-

-

14 September 2023

![Arm Holdings CEO Rene Haas poses with the Opening Bell Crystal at the Nasdaq MarketSite on September 14, 2023 in New York City.]()

-