Dave McCormick-Led Hedge Fund Shed Hundreds Of Jobs After Pocketing State Money

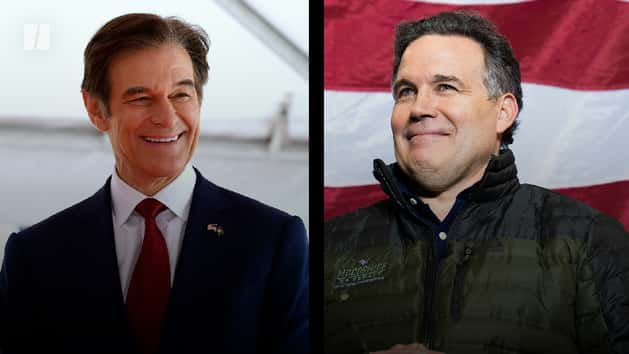

Dave McCormick, an especially rich hedge fund supervisor operating as a Republican for U.S. Senate in Pennsylvania, has constructed a lot of his political persona round his document of making jobs.

During his run for Senate final cycle, McCormick cited each his tenure as CEO of on-line public sale startup FreeMarkets within the early 2000s and main the hedge fund Bridgewater Associates from 2017 to 2022 as proof of his job-creating credentials.

“I was a leader of a company with my colleagues that created 600 jobs in Pittsburgh,” he stated in a Fox News interview in May 2022. “I then went on to run another global company. I know what it takes to create jobs.”

McCormick’s claims about his work at FreeMarkets have already wilted below scrutiny. As a candidate in 2022, McCormick initially stated he had created 1,000 jobs in Pittsburgh, when the truth is his failure to generate that quantity led to the partial withdrawal of a Pennsylvania state grant premised on hitting that marker.

But McCormick’s newer work on the helm of Bridgewater, an organization based mostly in Connecticut that’s the world’s largest hedge fund, paints his document as a job creator in a good much less flattering gentle and will change into a potent marketing campaign speaking level for incumbent Sen. Bob Casey, McCormick’s all-but-certain Democratic opponent. McCormick, a extremely touted GOP recruit, is essential to his get together’s plans to retake the Senate in 2024.

McCormick presided over a 400-plus individual discount at Bridgewater, regardless of the corporate receiving a $52 million subsidy bundle from Connecticut’s Department of Economic and Community Development in 2016 as a part of the state’s First Five Plus initiative, based on the Connecticut Mirror. After exiting the settlement in March final 12 months, CT Insider reported that Bridgewater was in a position to maintain the overwhelming majority of the grants, loans and tax credit it obtained, supplied that it remained within the state till May 2026.

“David McCormick’s only accomplishments as a hedge fund executive were to lay off workers, outsource American jobs, and sell out to China,” Maddy McDaniel, a spokesperson for the Pennsylvania Democratic Party, stated in an announcement to HuffPost. “Now, he’s pretending he was a successful business leader and job creator, but just like the rest of his campaign, that’s a blatant lie.”

Elizabeth Gregory, a spokesperson for McCormick’s marketing campaign, famous in an announcement to HuffPost that Bridgewater grew by 50% from 2009 – when McCormick turned president of the agency, however earlier than he turned CEO – to 2022. When he entered as president, the corporate had 800 workers; at his departure, it had about 1,200.

“Dave is a proven job creator,” Gregory stated. “Dave also created hundreds of jobs in the greater Pittsburgh area while at FreeMarkets, helping to take the company from a little over a hundred jobs when he joined in 1999 to nearly 900 by the time he sold the company as CEO at the end of 2004.”

Connecticut’s First Five Plus initiative entitles Connecticut-based corporations to loans, grants, tax credit and different types of assist in the event that they decide to both creating 200 full-time jobs inside two years or investing $25 million and creating 200 full-time jobs inside 5 years.

Bridgewater’s guarantees to Connecticut had been even loftier.

In alternate for retaining 1,400 jobs and creating one other 750 jobs, First Five Plus supplied Bridgewater with $22 million in loans and grants in May 2016. The principal of the 10-year, $17 million mortgage wouldn’t must be repaid within the first 5 years, and curiosity was simply 1% per 12 months. The state additionally supplied $5 million in grants that will by no means should be repaid. In addition, Bridgewater’s plans entitled it to $30 million in tax credit.

However, over the course of McCormick’s 5 years as co-CEO (and later, sole CEO) of Bridgewater, the corporate’s workforce shrank. Bridgewater’s workforce declined from 1,702 folks in 2017 (based on knowledge collected by the state authorities of Connecticut) to 1,264 folks by the top of 2021 (based on knowledge that Bridgewater supplied to the U.S. Equal Employment Opportunity Commission).

The reductions in workers measurement got here primarily from two adjustments that McCormick carried out, first as co-CEO in 2019 and once more as sole CEO in 2020. Despite reporting excessive returns for its flagship fund in 2019, Bridgewater outsourced almost 200 jobs in its finance, human assets and recruiting departments to the consulting agency Genpact. Outsourcing invariably permits corporations to make use of folks at a decrease price, actually because the personnel corporations with whom they contract present decrease pay and fewer advantages.

In the summer season of 2020, following losses at its flagship fund, McCormick laid off about 200 folks, based on the Wall Street Journal. When the layoffs started in July, folks near Bridgewater characterised the adjustments to the Journal as McCormick “putting his stamp on the firm” in his new capability as sole CEO.

After McCormick’s departure, Bridgewater continued to scale back its workforce, shedding an extra 100 folks this previous March, based on Bloomberg.

Around the identical time – and maybe on account of that transfer – the corporate ended its participation in First Five Plus. Under the phrases of Bridgewater’s termination of the settlement, it might forgo $18 million in tax credit that it might have in any other case been entitled to accrue within the preliminary deal, and pay the state $6.5 million in principal and curiosity on $6 million of the loans it obtained.

So lengthy as Bridgewater pledged to not relocate earlier than May 2026, the corporate would additionally be capable to maintain the $12 million in tax credit and $5 million in grants it already obtained, in addition to have its $11 million in excellent loans forgiven.